Last updated: 10 Apr 25 23:38:58 (UTC)

How a Living Trust Protects Your Family

“One of the most loving things you can do for your family is to provide for their future security with a living trust.” ―Gary Fitzgerald (he taught me everything I know about living trusts)

Table-of-Contents

Three Ramifications at Death

When a breadwinner passes away, there are generally three ramifications:

- Emotional trauma

- Financial insecurity (term life insurance)

- Legal entanglements (living trust)

My expertise lies in helping families with the last two.

What is a Living Trust?

A living trust is a legal document created by you during your lifetime. Just like a will, a living trust spells out exactly what your desires are with regard to your assets, your dependents, and your heirs. The big difference is that a will becomes effective only after you die and has been entered into probate. A living trust bypasses the costly and time-consuming process of probate, enabling your successor trustee to carry out your instructions as documented in your living trust at your death or if you’re unable to manage your financial, healthcare, and legal affairs due to incapacity.

- Avoids the costs, delays and the headaches of probate.

- Eliminates the Gift Tax.

- Pre-determine who will care for your minor children.

- Pre-determine who will care for you in your old age when you can no longer take care of yourself.

- Provides “dying” instructions.

- Determine who gets what at death.

Would you like your loved ones to receive their inheritance quickly, or wait up to two years or longer?

Would you like to keep your estate private or made public when you pass?

Would you like 100% of your estate to go to your loved ones, or would you rather they receive 95% and the other 5% go to attorneys and court fees?

Four Components of a Comprehensive Living Trust

#1: The Revocable Living Trust

This is the centerpiece of your Estate Planning Portfolio. The trust is completely under your control. It is fully revocable while you are alive. You may alter, amend (in whole or in part), or even revoke your trust at any time. You can transfer your assets back out of your trust just as easily as you can transfer your assets into your trust.

The person who manages the trust is called the Trustee (in most cases you are the Trustee initially). After your passing, the Successor Trustee you appointed can manage and distribute assets to the beneficiaries of the trust.

If you have children you can create a sub-trust to hold their assets until they reach a certain age or split distributions over time at three different ages. This prevents a potentially immature young adult from receiving a windfall that might cause more damage than good. You can even allow early withdrawal for educational expenses, first home, wedding or a business.

You can stipulate beneficiaries as “income only”, and prevent them from getting a lump-sum distribution and allow them only to draw and income for education, maintenance and support.

#2: Health Documents

Living Will and Advanced Health Care Directives allow you to determine how you want medical care administered if you have a terminal illness or are in a comatose state.

These instruments will serve to give notice to medical professionals your wishes, such as if you desire whether or not to be kept alive by artificial means.

Many healthcare providers require a Durable Power of Attorney for Healthcare (DPAH) in conjunction with a Living Will to carry out the decrees of a Living Will. It is important that your agents for your Durable Power of Attorney for Healthcare are the same as your Living Will.

The Durable HIPPA Statement grants an exception to the privacy restrictions of the HIPPA law to allow for personal information to be provided to the Agents you have appointed so they can make an informed decision regarding your medical care.

#3: Durable Financial Power of Attorney

This document appoints an agent(s) to perform financial decisions regarding any assets not funded into your trust at the time of your legal incapacitation. For assets already funded into the trust, the Trustee already has this authority.

Not only do you get to decide who makes financial decisions on your behalf, you also protect your privacy and save money by avoiding expensive court and legal fees.

Having a Durable Financial Power of Attorney will help help avoid a court-supervised guardianship / conservatorship in the event of legal incapacitation where all finances become a matter of public record.

#4: Last Will & Testament

The Last Will and Testament is better described as a “Pour-Over Will”. It is used in conjunction with a Revocable Living Trust and its primary function is to convey everything you have forgotten to fund into the trust prior to your death (hence “pour-over”).

Please note that unless your remaining assets are minimal in value, all non-trust (un-funded) assets must go through probate first.

In addition, you may appoint guardians for your minor or disabled adult dependents so you can be assured who will take custody.

Wills vs. Living Trusts

| Will | Living Trust |

|---|---|

| A Will takes you into Probate. | A Living Trust avoids Probate and saves you time and thousands of dollars. |

| Assets are frozen in Probate Court for six months to 2 years or more. | A Living Trust allows these same assets to be distributed within days. |

| A Will provides no privacy with public Probate Court Proceedings. | A Living Trust is a private document and is not made public. |

| A Will takes effect when you die and has no living benefits. | A Living Trust benefits you while you’re alive and after you’ve passed. |

| In Probate Court, anyone can contest a Will. | A Living Trust is settled without interference and extremely difficult to challenge. |

What the Experts Say…

For deeper research please read these articles:

“If you have some assets (maybe just a car and some nice furniture) or minor children, you still need an estate plan - even if taxes are not an issue.” ―Smart Money, Wall Street Journal Magazine, January 2012

“Only 23% of American adults over age 50 have a trust.” ―AARP Poll

“56% of Americans do not have any estate planning documents in place.” ―2011 National Survey by LexisNexis

“I never think a will is enough, I don’t care if you have no money. Everyone should have a Living Revocable Trust with an Incapacity Clause inside.”

―Suze Orman, Jan 13, 2012, Huffington Post

“Get yourself a living revocable trust. A will can be useful - but only if it’s accompanied by a trust. Not only is a trust a great way to manage your assets while you’re living, but it makes the inheritance process incredibly smooth.”

―Suze Orman, Ten Tips for a Prosperous 2006 – and Beyond

“If you’re a parent or about to become a one, get serious about planning.”

“Most importantly, be sure you name a guardian for your children and provide for them financially in case something happens to you.”

“Estate Planning starts with a fundamental goal: once you have provided for your own needs, take care of those you love.”

“The legal bill to prepare a trust can run from $2,500 to more than $15,000.”

“It always feel painful to spend money on estate planning because you don’t live to reap the benefits, even if you know your heirs will.”

―Deborah Jacobs, Estate Planning Smarts

“The living trust program I’ve been recommending (and own) for over 15 years is the most complete I’ve seen, and only costs $2,495.” ―Michael Thomas

”Probate accounts are a matter of public record, and anyone with the time and energy to go looking for them, from trust beneficiaries, disinherited heirs, or even newspaper reporters nosing around for some dirt, may access them.”

“Living trusts are an estate-planning technique designed to remove assets from the grantor’s estate, either directly to his or her heirs upon the grantor’s death or into his or her trust without ever setting foot in a probate court.”

”If you’ve created a living trust, your goal should be to transfer as many of your assets as you can into the trust during your lifetime.”

―Margaret A. Munro, Estate and Trust Administration For Dummies

“Norman F. Dacey wrote a best-selling book on ways to avoid probate, angering lawyers across the country. Dacey, an estate planner, showing how trusts could be set up to avoid the delays and expense of probate.”

―Norman Dacey, How to Avoid Probate

Celebrity Case Studies

Aretha Franklin Died Without a Will - Her estimated $80 million estate could be in jeopardy.

By David H. Lenok. August 2018 for Wealth Management

Deeply private in life, Aretha Franklin’s estate will be laid bare for all to see, as according to court documents, she died without having a will or trust in place.

It’s estimated at roughly $80 million and includes the rights to a number of her hit songs) pass through intestacy. That being said, even if family strife is avoided, the complete lack of wealth transfer planning on Franklin’s part will likely result in Uncle Sam taking a huge tax bite out of that figure.

In an interview with the Detroit Free Press , Franklin’s long-time entertainment lawyer Don Wilson doesn’t paint a particularly optimistic picture. “I was after her for a number of years to do a trust,” he said. “It would have expedited things and kept them out of probate and kept things private. Any time they don’t leave a trust or will, there always ends up being a fight.”

What is certain is that Franklin should have followed her own advice and taken some time to “Think” about her estate plan—or lack thereof.

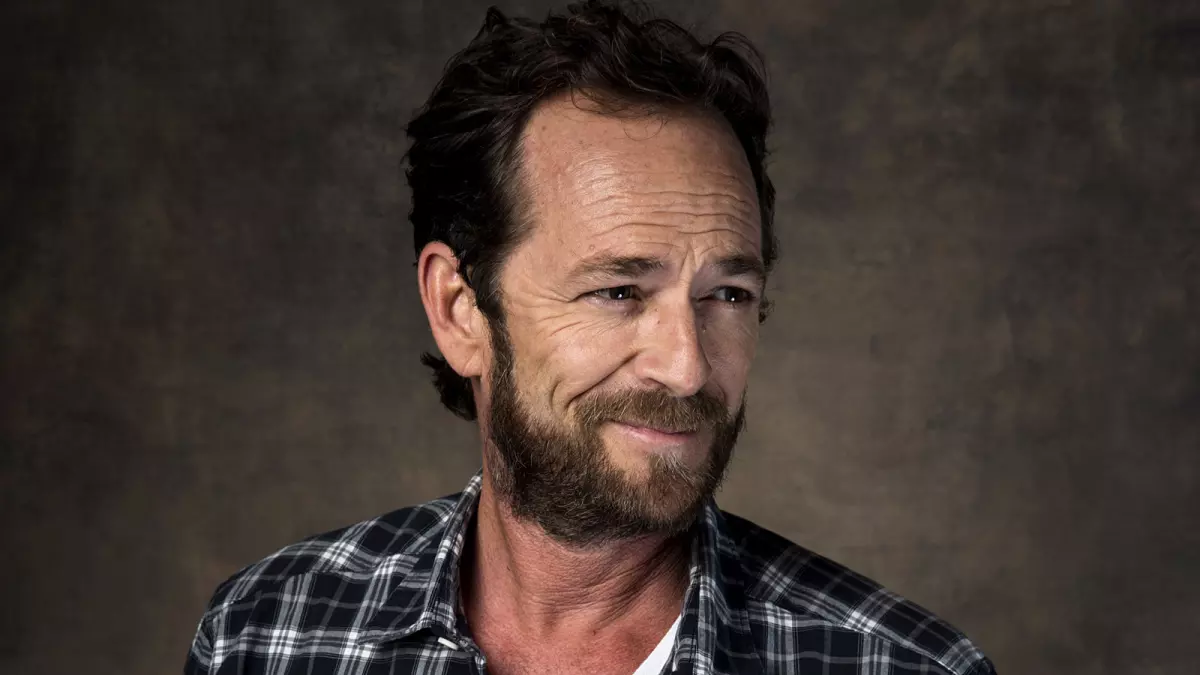

Luke Perry Protected His Family With Estate Planning

By Danielle and Andy Mayoras. April 2019, Forbes

When Luke Perry died on March 4, 2019, he was surrounded by family and loved ones. Fortunately, Perry’s foresight to do the proper estate planning meant that the tragedy was not made worse for his family.

The fact that the hospital allowed Perry’s family to end life support means that Luke Perry likely had executed the proper legal documents so that his family could make the decision. Specifically, in California, those wishes generally are made in writing, through an Advance Directive or a Power of Attorney. Without a proper legal document, Luke Perry’s family may have needed an order from a probate court to terminate life support, at least if family members disagreed. That would have been a public and emotional process that would have prolonged his suffering and made it even harder for his family.

Given that Luke Perry had a reported net worth of around $10 million, it is likely that he created a revocable living trust in addition to a simple will. If he had only a will, then his estate will have to pass through probate court. Instead, if Perry had a trust - which is far more likely - and if his trust was properly funded (meaning that he transferred his assets into his trust prior to death), then his assets can pass onto his children without court intervention.

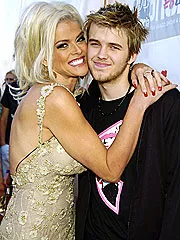

Anna Nicole Smith Leaves Everything to Dead Son

By Susan Candiotti. February 2007, CNN

Anna Nicole Smith left everything to her son Daniel, who died in September, according to a will released Friday by a Florida court.

The 16-page will was never updated. It does not mention Smith’s 5-month-old daughter, Dannielynn.

The stakes are huge - perhaps $88 million or more. Smith’s heir or heirs stand to inherit a stake in her longstanding claim to the $1.6 billion fortune of her late husband, Texas oil baron J. Howard Marshall II.

Five Estate Planning Lessons From The Paul Walker Estate

By Danielle and Andy Mayoras. February 2014, Forbes

The probate filing and will reveal that Walker had assets of about 25 million dollars. Second, the filing shows that Walker had a revocable living trust, benefiting his daughter as the sole beneficiary. Trusts, unlike wills, are private documents - so we do not get to see the actual trust document. The probate documents only reveal that the trust exists and that Meadow is the sole beneficiary of it.

- Paul Walker Placed His Trust In A Trust.

- To Be Most Effective, Trusts Need To Be Fully Funded During Life.

- Naming A Guardian For Minor Children Is Always A Good Idea.

- No One Should Wait Until They Are Old To Do Estate Planning.

- Wills, Trusts, And Other Estate Planning Documents Need To Be Updated.

James Gandolfini will a tax ‘disaster,’ says top estate lawyer

By Dareh Gregorian. July 2013, NY Daily News

The taxman is coming after James Gandolfini’s heirs. The late “Sopranos” star’s will is “a disaster” that could see over $30 million of his estimated $70 million estate go to the government.

“It’s a nightmare from a tax standpoint,” said William Zabel, who reviewed the document. The 51-year-old’s “big mistake” was leaving 80% of his estate to his sisters and his 9-month-old daughter, Zabel said. That made 80% of the estate subject to “death taxes” of about 55%, and the bill is due in nine months.

That means his family will have to start selling off his property and liquidating his assets soon in order to pay the tab, since it’s unlikely the actor had tens of millions of dollars in cash on hand. “The government doesn’t accept the fact that it’s difficult to come up with the money you owe,” said the lawyer.

Charles Kuralt Died without a Living Trust

Charles Kuralt, American journalist, correspondent, and news anchor, died 4, July 1992 from Lupus.

It wasn’t until after Kuralt’s death that an extramarital affair came to light, and even then only because the woman contested his will. Apparently Kuralt had purchased a renovated schoolhouse on 90 acres in southwestern Montana, where he kept Patricia Shannon, his mistress of 29 years. He also bought her a cottage in Ireland and paid for her kids’ college tuition. Over the first decade of their relationship, Kuralt gave her something like $600,000. “Charles always said, his refrain through all of his life, ‘Don’t worry, we’re rich,’ he would say. Charles took care of all my needs.”

After a prolonged legal fight, not only did Ms. Shannon win the property in question, but Kuralt’s daughters were forced to pay the mistress’s estate taxes, amounting to $350,000.

Jimi Hendrix Died Without a Living Trust

Source: The Lessons of Famously Bad Estate Planning.

Guitar great Jim Hendrix died in 1970 without a will or living trust, setting up a family fight that would end up in court more than 30 years later. His father, AI, had cut Jimi’s brother out of the estate and left the Hendrix legacy in control of AI’s adopted daughter, Janie, from his second marriage.

Odds are good that Jimi Hendrix would not have expected these turns of events. but he had no say in the matter because he did not leave a will or living trust.

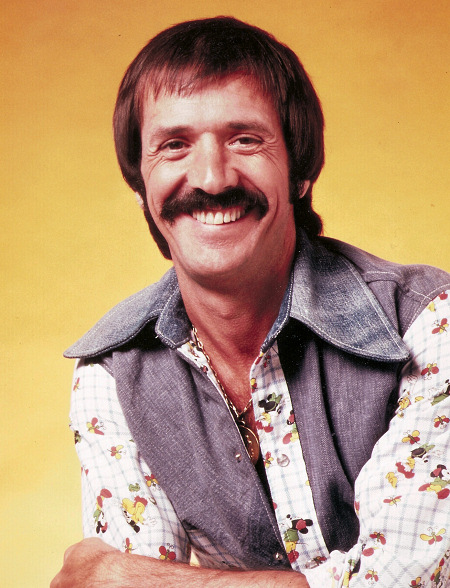

Sonny Bono Died Without a Living Trust

Source: The Lessons of Famously Bad Estate Planning.

When Sonny Bono died on January 5th 1998, in a skiing accident, he did not leave a will nor living trust. Sonny’s widow, Mary barely had time to grieve. She had to run to court so she could be appointed the estate’s executor.

Other people, including Cher, lined up to make claims against the estate. Then there was the inevitable love child. They actually had to take a DNA sample from Sonny’s body to determine whether this was actually a child of his. Sonny could have saved his widow a lot of grief and aggravation by getting a simple Living Trust.

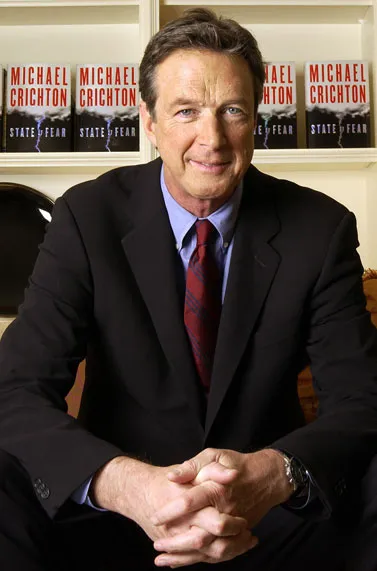

Michael Crichton Disinherited His Unborn Child

Source: The Lessons of Famously Bad Estate Planning.

Michael Crichton did leave a will and also excluded any unborn children. This is a typical provision for a high-net-worth man. When Crichton died of throat cancer, his fifth wife was six months pregnant and his will disinherited that child.

This highlights the importance of updating your estate planning documents. It should be done as soon as a life event happens.

Frank Made Sure It Was “His Way”, Even Posthumously

Source: The Lessons of Famously Bad Estate Planning.

Frank Sinatra included a very detailed no-contest clause in his living trust. This meant that anyone who fought the will or trust by using any of the 13 legal actions listed would be disinherited.

Despite his trust favoring some children over others, no one contested.

Michael Jackson Failed to Fund His Living Trust

Source: The Lessons of Famously Bad Estate Planning.

Michael Jackson named people as executors of his trust who were not in the Jackson family. That ensured a fight from his mother, Katherine.

But that would not have gotten much traction had he adequately funded the trust, which he did not do.

Special Needs Trust

If a family has a child with special needs, such as a permanent physical / mental / emotional impairment requiring a lifetime of care, a Special Needs Trust can provide for the ongoing care of the child even after the parents die.

“With a special needs trust the child can still be eligible for public assistance upon reaching age 18.”

“Like other trusts, special needs trusts also protect assets from claims of creditors, and people who may prey on the beneficiary.”

―Deborah Jacobs, Estate Planning Smarts

“Our living trust has a special needs trust option for only $150.” ―Michael Thomas

For deeper research read these short articles:

The Company I Use

The estate planning company that I’ve been recommending to my clients for over a decade also prepared my family’s trust (and my parents). They’ve been in business since 1989 (coincidentally, the same year I entered the financial industry), and they have a A+ Rating by Online Better Business Bureau.

They specialize in Estate Protection (ie, they’re not a “trust mill” or an online do-it-yourself), and their living trust is the most complete I’ve seen. It includes the Living Trust, Pour-Over Will, Medical Directive, A Living Will, Nomination of Conservator, Durable Power of Attorney for Assets and Healthcare, Guardian for Minor Children, and comes with free lifetime changes and free lifetime support.

Next Steps

Schedule a chat with me and we can discuss living trusts, wills, special needs trusts, land trusts and LLCs. When you’re ready the process is (I will personally walk you through all of the steps):

- I’ll collect some basic information from you to get the application started.

- I will create a DocuSign application with the data gathered in the above step. I will email the DocuSign for you to e-sign.

- After you e-sign it, your credit card (MC, VISA, Discover, AMEX) will be charged and Heritage will begin building your trust.

- At this stage, Heritage will communicate with you directly to fine-tune your exact wants-and-wishes of your trust.

- Once completed your living trust will be mailed to you. You’ll need to get your signatures notarized from a local notary.

- Finally, if you’re a homeowner you’ll need to re-assign your house deed to the trust. This is usually done a your County Registrar’s Office (or similar department).

Michael Paulding Thomas

-

Celebrating 35 years in the industry

-

Investment Advisor • Securities Principal

-

Series 6, 26, 63, 65, Term Life, Living Trusts

-

714.602.3192

-

Securities offered through Innovation Partners, LLC. Member FINRA/SIPC