Last updated: 22 Jul 25 23:40:35 (UTC)

Michael's Financial Philosophy & Service Model

“This essay started over 34 years ago when I entered into the investment business and began cataloging my beliefs and insights. Eventually I shared it with a few clients (on physical paper!) when they asked for a brief summary of my financial philosophy (in time it expanded into a monthly newsletter). What you’re reading now is my most current edition of my original notes.” ―Michael Paulding Thomas

Table-of-Contents

COUNTER-CULTURAL PHILOSOPHY

I have a unique point of view that can be described as going upstreamnn0 to the traditional financial industry and often times against conventional wisdom. I commit to always tell you the plain, unvarnished truth, especially when you may not want to hear it.

The five principles below are the foundation of my investment philosophy which is primarily based upon the teachings of Nick Murray and Warren Buffet ― and not what you may see on the news on any given day, or what the “industry” is currently promoting.

1. Do What’s Right

This has been my guiding philosophy since I started in this industry in 1989. When I sit with a client I ask myself, “What would I do for myself and my family if I were in this situation?” Then that’s what I recommend.

This includes the way I choose to get paid - prioritizing lower-costs for you over my income.

“The truth tellers have no competition.” ―Nick Murray

“I want to be happy by doing well by doing good.” ―Michael

“Don’t sell anything you wouldn’t buy yourself.” ―Charlie Munger

“Ethics in business means don’t sell anything you wouldn’t buy.” ―Naval Ravikant

“If you don’t believe in what you’re offering, no one else will either.” ―Tom Hopkins

“Do what’s right.” ―Art Williams

2. Make a Complex Subject Simple

I keep my presentations, explanations, strategies and investments as simple as possible. I don’t use fancy jargon nor try to impress you with sophisticated language, charts and graphs.

I cut through the industry’s noise and complexity and provide a simple answer.

“Everything must be made as simple as possible, but no simpler.” ―Albert Einstein

3. Invest 100% in the World’s Great Companies via Mutual Funds

My investment philosophy is goal-focused and long-term oriented in an industry that will always be market-focused and short-term performance-driven.

Most people who invest most of their capital in fixed income investments as they go into retirement will run out of money well within their lifetimes. You are not investing to retirement, but through retirement, and very probably on to the next generation. The right answer is to invest in historically defensible, broadly diversified, mutual funds.

Equities = life. Bonds = death-in-life.

“Equities are the only asset class that fully captures human ingenuity, which is the most valuable asset on earth.” ―Nick Murray

-

My equity investment management firm of choice is Capital Group / American Funds (all of my family’s money is managed by them).

-

I have a strong conviction in dollar cost averaging.

-

Finally, I don’t believe in chasing whatever the the current “hot” investment of the moment is (crypto, hedge funds, alternatives, REITs, options, futures, opportunity funds - the list is endless). I am data-based and fact-driven.

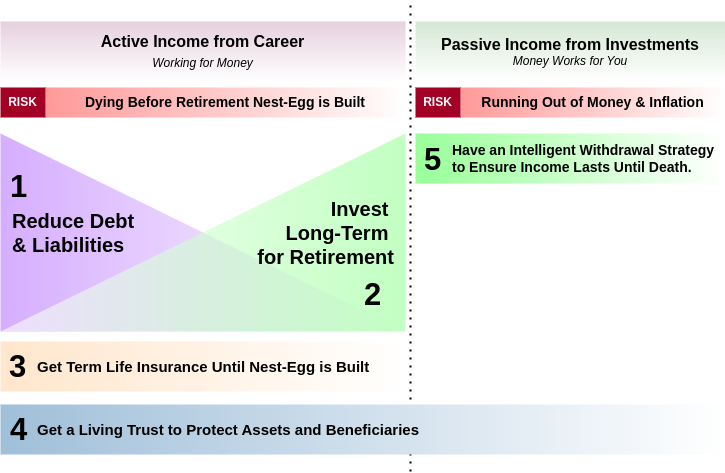

4. Have an Intelligent Retirement Withdrawal Strategy

Americans say that what they want for retirement is safety and income. What they really want is all the income they can get, and the illusion of safety. The best vehicle to create a guaranteed retirement income that outpaces inflation is a variable annuity with a guaranteed income rider that is invested in 100% equities, and yet provide a minimum 5% guaranteed withdrawal for the rest of your life.

5. Proper Investor Behavior via Coaching

At the end of an investor’s life, 95% of his total lifetime return will come from how the investor behaved. And the primary determinant of that behavior will be the quality of the advice he got, or didn’t get. I believe you will do far better in real life with an empathetic, tough-loving behavioral coach than you will on your own.

“Without an adequately compensated advisor to help with selection and discipline, the individual investor will simply make all the classic and horrendous mistakes.” ―Nick Murray

“People make better decisions with financial advisors.” ―Robert Shiller, Nobel Prize-winning economist

FINANCIAL CHECKLIST

Retirement

-

401(k). Contribute up to the matching point.

-

Roth / Traditional IRA. Fully-fund your IRA. Roth is preferable, if you qualify for it.

-

401(k). Contribute past the matching point up to the maximum allowed.

-

SEP IRA. If you’re self-employed and/or get paid via 1099.

-

Variable Annuity - pure growth. If you have additional money available to invest for retirement, use a VA for tax-deferral.

-

Variable Annuity - guaranteed income. When you’re approximately 10-years from retirement withdrawals start this product.

- View my Retirement Presentation.

Minor Accounts

-

UTMA. When saving for your child for non-education purposes invest in a Uniform Transfer to Minor Act.

-

529-Plan. For higher-education / college invest in a 529-Plan.

-

Roth IRA. As soon as your child as earned-income, such as a summer job, have them invest in a Roth IRA.

-

ABLE Accounts. Achieving a Better Life Experience Act allows individuals with mild to severe disabilities to open investment accounts.

Emergency / Protection / Insurance

-

Emergency Fund. I recommend saving three to six months living expenses. I like the American Funds Tax-Aware Conservative Growth and Income Portfolio.

-

Living Trust. If you are married, have kids or real estate you need a living trust to avoid probate (and much more).

-

LLC + Land Trust. If you have rental properties and/or want to really protect your real estate against law-suits etc.

-

Term Life Insurance. Always get term insurance. How do you know if you need life insurance? Ask yourself if your spouse/kids will have financial problems if you die? If ‘yes’ then you need it; if ‘no’ then you don’t. This is why you usually only

Big-Picture Strategy

- Watch my 12-minute video explaining the philosophy.

WHAT I DO AND WHAT I DON’T

| Crafting a long-term plan and funding the plan with a long-term equity portfolio: | 20% |

| Coaching clients to continue following the plan through all the cycles of the economy, and all the fads and fears of the market: | 80% |

| Analyzing/interpreting the economy and current events. Timing the market, calling tops and bottoms. Identifying consistently top-performing investments: | 0% |

| 100% |

MY SERVICE MODEL

- First and most important, please don’t hesitate to call, email or schedule a time with me for any reason whatsoever. I commit to returning your emails, calls, and voicemails within 24 hours. Note: all account-specific, product-specific and Advice needs to be communicated via email or phone, not text.

- Next, I’ll certainly call/email if something is going on and that’s important enough to require a decision of some sort. This will rarely happen, as our whole philosophy is based on not reacting to current events in the economy or the markets.

“Nothing that happens in 90 days can have any bearing on a long-term investment plan.” ―Nick Murray

- Once a month I will email my client newsletter (subscribe here) which includes the current month’s Client’s Corner by Nick Murray, the Podcast-of-the-Month, the Financial Book-of-the-Month, and my Financial Tip-of-the-Month. In the July and January issues I will include my Mid-Year nd Year-End Client Letters.

- Finally, every January I will email a summary of your plan, and most importantly, show you the number of shares you own of your mutual fund(s).

Other than that: not much. It’s deliberately relaxed, informal, friendly - but most of all open, in both directions.

FREQUENTLY ASKED QUESTIONS

This whole retirement planning thing frustrates me.

I’ll walk you through the different retirement accounts and ensure you’re contributing the right amounts to the right places.

Do I have to watch the markets every day?

Absolutely not. That’s my job, and that of the money managers whom we hire. They’ll handle portfolio adjustments and I’ll keep an eye on your assets so you don’t have to stress over daily changes.

I wish there was an easier way to understand investments.

I pride myself in making a complex subject, simple. I will break down complex investments and explain them in plain English.

RECOMMENDED READING

Articles & Essays I’ve Written and/or Compiled

Books

This is the best investment book I’ve ever read, and a great summary of my investment philosophy. If what you read here resonates with you then you’ll love working with me. If it doesn’t, then you won’t.

This is the story of Capital Group/American Funds - the company managing your money (and mine). It is a compelling read.

Other Resources

This is a collection of quotes and thoughts from some of the world’s greatest investors.

-

Capital Group Podcast. This is an excellent audio-podcast from American Funds that provides insights into the world of investing. Very engaging and non-technical.

-

Additional financial books for clients. This is a list I’ve compiled over decades of the best financial books for clients, in no particular order.

-

Subscribe to my monthly client newsletter. I send out 12 issues a year and will not “spam” you.

-

Accolades & Thank You Notes from Clients and Advisors I’ve Trained

MY CONTACT INFORMATION

Michael Paulding Thomas

-

Investment Advisor • Securities Principal

-

Series 6, 26, 63, 65 • Life

-

Mutual Funds • IRAs (Roth, Traditional, SEP, Simple, Minor-IRAs) • 529 College Plans • UTMA minor accounts • ABLE accounts • Variable Annuities • 401k Plans • Term Life Insurance • Living Trusts, Land Trusts, LLC’s.

-

714.602.3192

Securities offered through Innovation Partners, LLC. Member FINRA/SIPC